Roth Contribution Income Limits 2024 Over 55. For 2024, the maximum contribution limit for a roth ira is $7,000 for individuals under the age of 50. For 2024, the limit is $7,000 ($8,000 if age 50 or.

Find out the contribution limits,. For those aged 50 and older, the limit is $8,000, which includes an additional.

Roth Ira Contribution Limits 2024 Over 55 Wilie Julianna, Find out the annual limits for traditional and roth iras, the deduction rules, and the age and income requirements.

Roth 2024 Contribution Limit Irs Teena Atlanta, The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Maximum Roth 401k Contribution 2024 Halli Elianore, For those aged 50 and older, the limit is $8,000, which includes an additional.

Roth Ira Limit 2024 Cal Iormina, Learn the max you can save in your roth 401 (k) for 2023 and 2024, and how to avoid excess contribution penalties.

Roth Ira Contribution Limits 2024 Over 50 Brina Claudie, Learn how your income affects your roth ira contribution limit for 2024.

Roth Ira Contribution Limits 2024 Sasha Costanza, The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

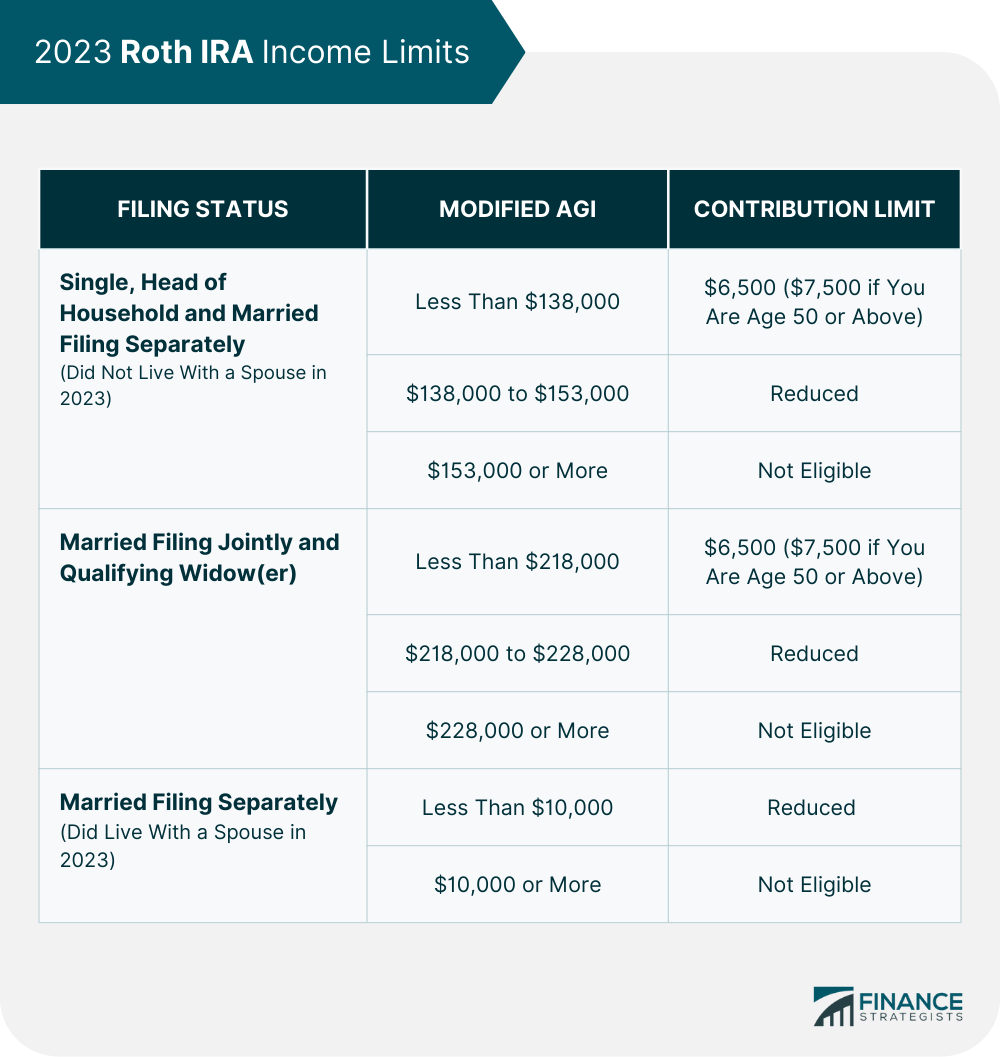

Roth IRA Contribution Limits 2023 & Withdrawal Rules, For those aged 50 and older, the limit is $8,000, which includes an additional.

Roth 401 K Limits 2024 Over 55 Xenia Karoline, Learn how your income affects your roth ira contribution limit for 2024.